Why do business in Hong Kong?

Being both the gateway to South China and the sea-routes nexus of Asia and the world, Hong Kong enjoys its unique geographic advantage. As an international finance and business centre, Hong Kong has been elected as the freest trade district for consecutive ten years, by Forbes. Against the backdrop of economic globalization, Hong Kong has become the springboard for Chinese investors to the outside world and vice versa. Business environment Being the centre of Asia, Hong Kong is also known as the most internationalized city in Asia. It is always a dynamic metropolis known for its cultural mix of east and west. As the freest economy in the world, Hong Kong has a sound legal system, free flow of capital, a simple and clear tax system, low tax rates and complete infrastructure, in short, providing a business environment of fair competition for investors both home and abroad. Legal system The legal system in Hong Kong is based on common law and is supplemented by the local laws. The legal system of Hong Kong exercises the principle of judicial independence. The law officers are not influenced by the administrative organ of the government or the legislature when performing their duties. Tax system Income tax: the tax rate is 16.5%, one of the lowest around the world. Duty: All goods are exempt from the duty except for imported cigarettes, wine, hydrocarbon oil and methanol. Salary tax: the tax rate ranges from 2% to 17%, which is one of the lowest around the world. Exchange control There are no exchange controls in Hong Kong, and the foreign exchange market is developed with active trading. In addition, Hong Kong is the sixth largest foreign exchange trading centre, with a state-of-art foreign exchange clearing system. Financial market Hong Kong is reputed as a major financial centre due to its high market transparency, strict disclosure requirement to financial institutions and prudent supervision. Hong Kong ranks thirdly in the Global Financial Centres Index issued by the City of London in March 2010. As of December 31, 2010, there are 1,244 and 169 companies listed on the Main Board and GEM respectively, with total market capitalization amounted to HK$210,769 trillion. Banking services Hong Kong is one of the cities with the most international banks, where some 70 out of top 100 banks have operations in Hong Kong. As of the end of 2010, there are 1960 recognized banking institutions and 70 representative offices in Hong Kong. Hong Kong is the third largest syndicated loan centre in Asia Leveraging on the “Mainland and Hong Kong Closer Economic Partnership Arrangement” (CEPA), the barriers for Hong Kong banks to enter the Chinesemarket is lowered. Effective from July 2009, Hong Kong banks have been approved to handle Renminbi settlement for cross-border trading. According to the Supplement VI to CEPA, any foreign bank branch established in the Guangdong province by a Hong Kong bank can apply to establish “cross-location” sub-branches (i.e. different from the municipality where the relevant branch is located) within the Guangdong province, which shall take effect from October 2009. Transportation Hong Kong has an extensive transportation network comprising the airport, railways, highways, container terminals, inland terminal depots and trans-boundary transportations. The complete transportation infrastructures closely connect Hong Kong and mainland China to the world, which contributes to the development of...

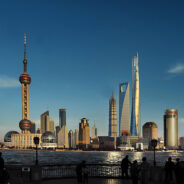

read moreChina (Shanghai) Pilot Free-Trade Zone (Chinese: 中国(上海)自由贸易试验区) is a free-trade zone launched in Shanghai on September 29, 2013. Backed by Chinese Premier Li Keqiang. It is the first free-trade zone launched by the Chinese government.

China (Shanghai) Pilot Free-Trade Zone (Chinese: 中国(上海)自由贸易试验区) is a free-trade zone launched in Shanghai on September 29, 2013. Backed by Chinese Premier Li Keqiang. It is the first free-trade zone launched by the Chinese government.

read more国家税务总局关于纳税人资产重组有关增值税问题的公告(国家税务总局公告2013年第66号)

现将纳税人资产重组有关增值税问题公告如下: 纳税人在资产重组过程中,通过合并、分立、出售、置换等方式,将全部或者部分实物资产以及与其相关联的债权、负债经多次转让后,最终的受让方与劳动力接收方为同一单位和个人的,仍适用《国家税务总局关于纳税人资产重组有关增值税问题的公告》(国家税务总局公告2011年第13号)的相关规定,其中货物的多次转让行为均不征收增值税。 资产的出让方需将资产重组方案等文件资料报其主管税务机关。 本公告自2013年12月1日起施行。 纳税人此前已发生并处理的事项,不再做调整;未处理的,按本公告规定执行。 特此公告。 政策解读 一、本公告出台的背景 《国家税务总局关于纳税人资产重组有关增值税问题的公告》(国家税务总局公告2011年第13号,以下简称“13号公告”)发布后,在鼓励企业整合资源、兼并重组方面发挥了重要作用。近期部分地区税务机关反映,一些纳税人在进行资产重组时,将全部或者部分实物资产以及与其相关联的债权、负债通过多次转让,但最终的受让方与劳动力接收方为同一单位和个人,这种情形的资产重组中涉及的货物转让行为是否征收增值税,请求总局予以明确。 二、为什么说纳税人在资产重组过程中,通过合并、分立、出售、置换等方式,将全部或者部分实物资产以及与其相关联的债权、负债经多次转让后,最终的受让方与劳动力接收方为同一单位和个人的,仍适用13号公告规定?...

read more香港投资定居全年申请料破10000宗! 抢搭末班车正当时。

香港投资移民第三季度申请人数高达3380宗!同比增长102%, 预计2013年全年申请将破10000宗, 创历史新高! 今年不仅是香港投资移民的“十周年”,也到了三年一度的“检讨期限”,据悉香港政府极有可能在2014年1月份的施政报告中再次提高香港投资移民的门槛,业界预计升价到1500-2000万港币。目前正是抢搭香港投资移民黄金末班车的关键时刻。香港投资移民推出至今刚好十年历史。截至2013年9月30日,累计申请人数已高达32984宗,吸金1563亿港元! 以下数据是根据香港政府官方公布的数据统计而来。 2003-2013年投资移民申请统计数据 2003年10月27日,香港政府推出“资本投资者入境计划”,当时最低投资额为650万港币,最初几年只收到几百宗申请,之后稳步上升。2010年10月,香港政府宣布将该计划投资门槛从650万港币调高至1000万港币,并将房地产从投资类别中剔除,当年一度出现赶末班车潮,申请数达6700多宗,创历史最高。但这一举动只在次年带来一个短暂的缓冲期,2012年全年6508宗申请个案创历年第二高。 香港投资移民每三年进行一次检讨,今年刚好是香港政府提高投资门槛的第三个年头,申请人数骤增,截至2013年9月30日,今年前三季度申请人数已达6492个,同比增长73%!申请人数即将超过2012年全年6508宗。接下来的第四季度会再次出现赶末班车潮,今年申请人数必然创下十年新高! 《2013年胡润财富报告》显示,全国有105万千万富豪和6.45万亿万富豪,分别比去年增长3%和2%。 招商银行和贝恩公司联合发布的《2013中国私人财富报告》发现,在2万名拥有可投资资产超过1亿元的中国富人中, 27%的人已经移民, 另有47%的人正在考虑移民。超级富人高达74%的移民比例,真是一个惊人的世界纪录。中国银行发布的《2011年中国私人财富管理白皮书》显示, 在中国高净值人群(定义为可投资资产在1000万元以上的人口)中,14%的人已经移民海外, 另有46%的富人正在计划或者办理移民的过程中。等到后者也完成移民手续,那么,每5个有钱的中国人中, 将有3个是外国国籍。 资本投资者入境计划申请人的分类 (截至2013年9月30日) 从香港政府官方公布的数据来看,十年香港投资移民计划,累计申请人数32984人,其中中国内地人达29188人,这说明,10个申请香港投资移民的人群中,差不多9个是中国内地人。 为何香港投资移民掀起一片移民热潮? 1、申请条件简单,只需投资1000万港币于政府或许的金融资产类别,并且无需审核资金来源 2、主申请人可携同受养人(即配偶及十八岁以下未婚子女)来港居留,无须额外投资 3、申请程序快捷,最快约6个月左右即可获批 4、可保留内地户口,不影响内地生意和生活 5、一人申请,全家可获香港护照,免签145多个国家和地区 ...

read more